The Misfits: Dr. Reddy's Laboratories Limited (RDY)

A generics drugmaker has some inherent advantages, and Dr. Reddy's has used them to generate spectacular results.

The mental image of “Big Pharma” is probably different than what many people think.

Most will imagine the big pharmaceutical companies that develop new drugs and price these new therapies at rates similar to a down payment on a new home. These exorbitant prices mean these companies make more money than they know what to do with them.

If you subscribe to this theory, then one would assume that these pharmaceutical giants would run laps around the broader market.

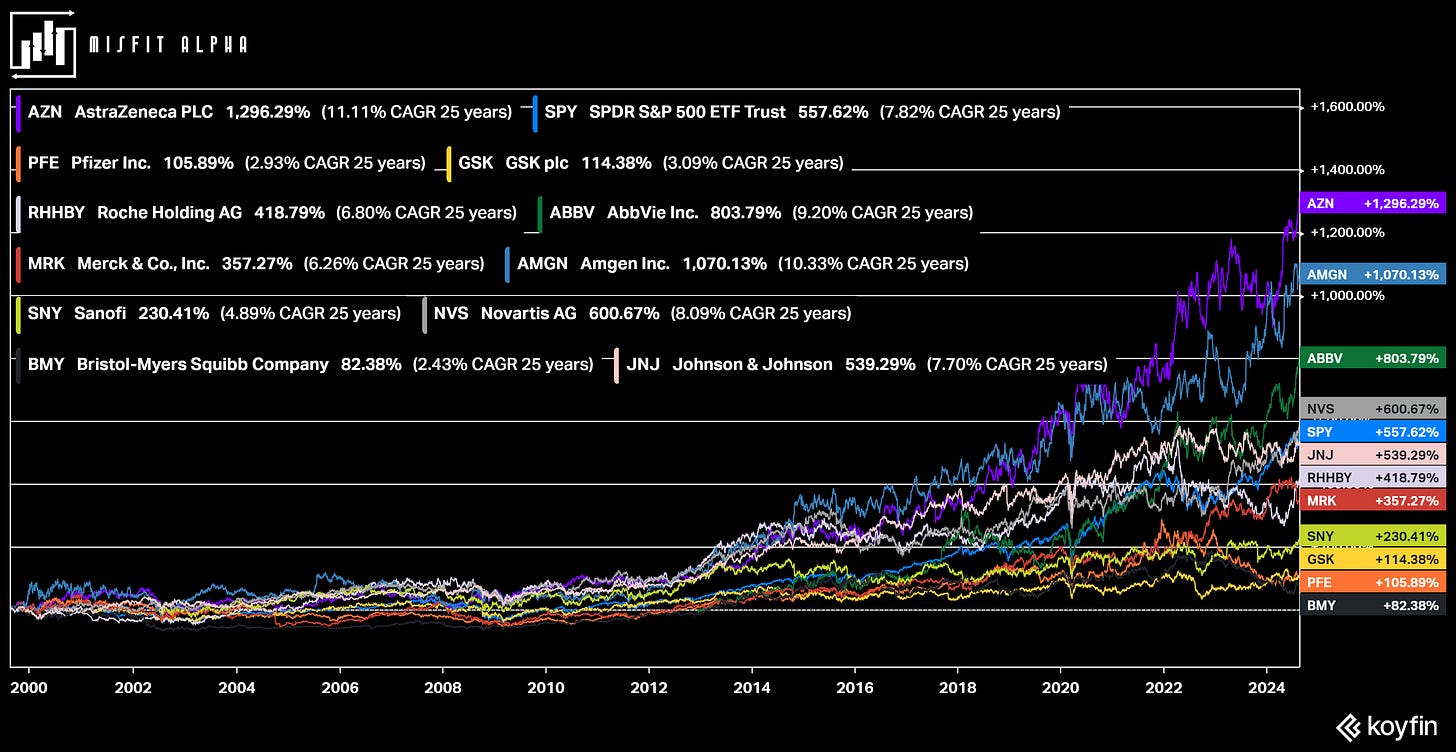

That isn’t really the case, though. Despite companies developing several blockbuster drugs and reaping the whirlwinds, most of the largest pharmaceutical giants have more or less matched the market’s performance over the past 25 years. Remember, too, that 25 years ago was near the top of the dot-com bubble, and annualized returns for the S&P 500 over that period are a measly 7.8%. That isn’t exactly a high bar to clear.

(For those scoring at home, I deliberately excluded Eli Lilly (NYSE: LLY) or Novo Nordisk (NYSE: NVO) from this chart. The GLP-1 drugs these two manufacture are such ridiculous outliers that it’s hard to lump them in with the rest).

This doesn’t necessarily make them bad companies or bad investments, but it does mean that people looking to make market-beating investments either need to know that some blockbuster is about to hit the market or buy them during periods of exceptionally low valuation.

The confounding thing about the healthcare and pharmaceutical industry is that dozens of market-beating companies are in the space. Instead of being the discoverer of novel molecules and biologics, though, they are the ones that make the sausage.

West Pharmaceutical Services (NYSE: WST)

ICON plc (NASDAQ: ICLR)

Charles River Labs (NYSE: CLR)

UFP Technologies (NASDAQ: UFPT)

Mettler-Toledo International (NYSE: MTD)

Utah Medical Products (NASDAQ: UTMD)

I’m sure I’ll be covering more healthcare sausage-makers in the future, but they aren’t the only ones that benefit immensely from the presence of “Big pharma”: The generics and biosimilar manufacturers.

India, specifically Hyderabad, has developed a cottage industry out of supplying drug ingredients to the formulators and then building generics for a fraction of the cost of the big brand names. Some of them have been truly spectacular investments. But for a (mostly) American investor base who read this, let’s focus on the one Indian generics manufacturer with an ADR on the U.S. exchange: Dr. Reddy’s Laboratories (NYSE: RDY).

Since going public in 2001, its results have put the rest of “Big Pharma” to shame.

Let’s look at some of the structural reasons why a generic manufacturer is the type of business to which investors should be attracted.

Shoutout to Koyfin for their data and charts. Koyfin has become an integral part of how I screen for, track, and analyze companies. Thanks to having a decade of data at my fingertips instead of manually going through stacks of quarterly and annual filings, the analysis process has become more thorough and much faster.

Up your analysis process by Signing up for Koyfin. Click on the link below and receive 10% off your annual subscription.