The Misfits: Utah Medical Products (UTMD)

Few companies 100 times the size of Utah Medical can claim to have rewarded shareholders as much as this small medical device supplier.

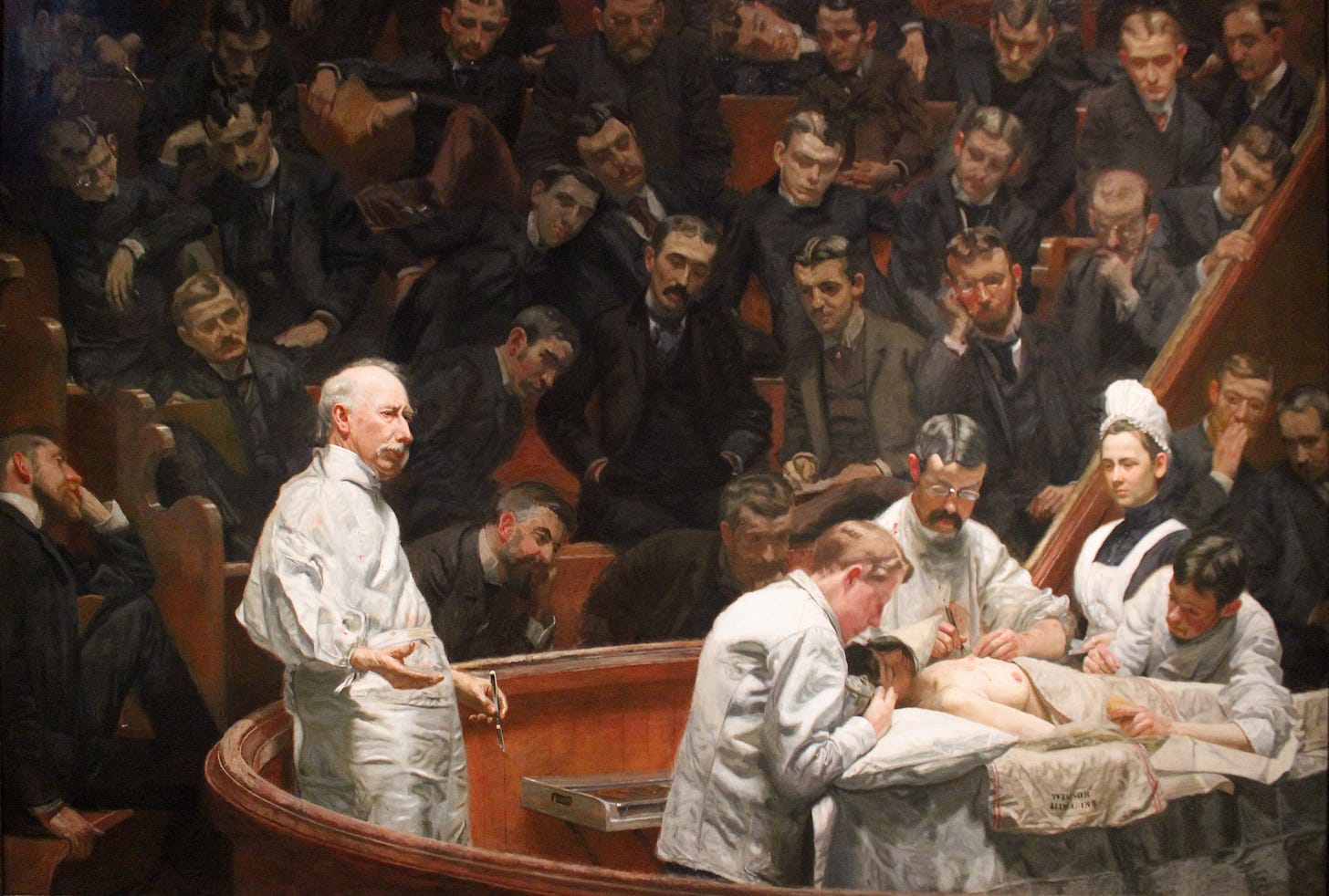

The Agnew Clinic, Thomas Eakins, 1889, oil on canvas (Philadelphia Museum of Art)

Perhaps the greatest sign of enduring strength for a business is its ability to return more capital to shareholders than it took in. Companies that have been around for decades and are prolific dividend payers and buyback machines will have likely given back much more capital than their initial public raise.

In a slightly incomplete research of businesses, I think I have found the company with the highest ratio of capital returned to capital raised ever to grace the capital markets: Utah Medical Products.

In 40 years of being a public entity, Utah Medical has returned 108,000 times more cash to investors than it took in at its IPO (and never did a secondary raise).

A return like that should have every analyst following this stock’s every move. As of this writing, though, no analysts on Wall Street follow this company.

So how did Utah Medical Products, one of the greatest capital return mechanisms over the past 40 years, fly under the radar for so long?

Let’s see if we can bring this medical supply company into focus.

Shoutout to Koyfin for their data and charts, without which much of the research for this piece wouldn’t be possible. Sign up for Koyfin here and receive 10% off.