The Once (and Future?) Misfit: Atrion Corporation (ATRI)

The company has an enviable position in the medical device industry. Why have things gone sideways?

One of the essential components of being a good investor is extracting lessons from all types of companies. Often, we focus our time on winning companies to see how they tick and what to look for in other investments. Less frequently do we think about bad ones or good businesses that have deteriorated over time. If we don’t study the ones that go poorly, how will we know what to avoid or look out for in the future?

Some companies like this can be fascinating studies because it can be hard to pinpoint precisely what has gone wrong. One such company is Atrion Corporation (NASDAQ: ATRI). It is a small medical device manufacturer that makes the only system for delivering fluids and mixed drugs to the heart during open-heart surgery.

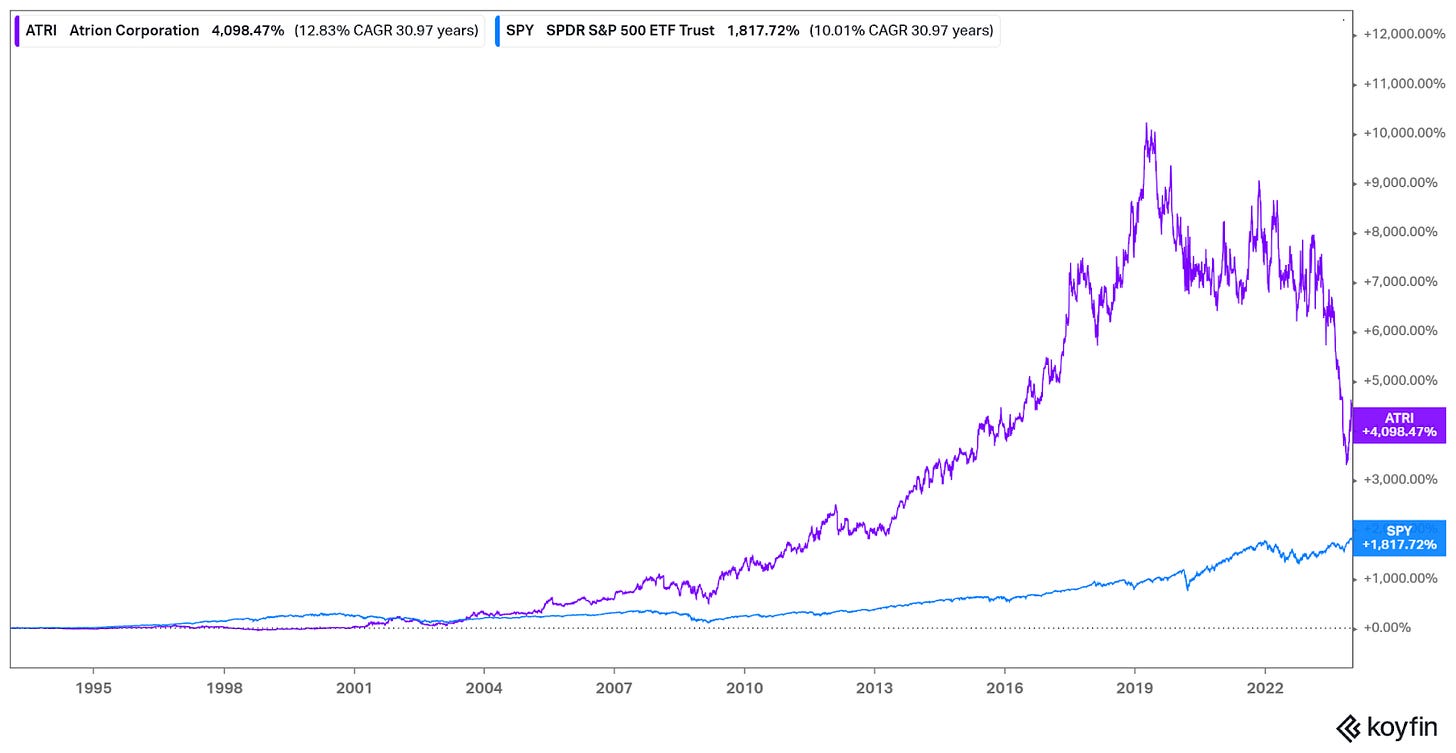

Any company claiming a monopoly on an essential medical procedure should, in theory, print money. For years, that was the case. From 1993 to 2019, Atrion’s returns were more than ten times those of the S&P 500 index. Since then, though, the stock and its financials have been deteriorating.

It’s not like this steep decline is only from speculators making deranged Ozempic trades either (everyone’s skinny now, short heart surgery!). There have been some signs of deterioration that can be hard to pin down.

So let’s dig into Atrion and see what we can learn about when a company goes sideways and whether it can recover its winning ways.

Shoutout to Koyfin for their data and charts. Koyfin has become an integral part of how I screen for, track, and analyze companies. It has made the analysis process much faster thanks to having a decade of data at my fingertips instead of manually going through stacks of quarterly and annual filings.

Up your analysis process by Signing up for Koyfin. Click on the link below and receive 10% off your annual subscription.