The Misfits White Mountains Insurance Group Inc. (WTM)

White Mountains Insurance poses the question that plagues so many investors. How patient are you?

I’m guessing that the only reason anyone may have heard of White Mountains Insurance Group (NYSE: WTM) before is because they fat-fingered Walmart’s (NYSE: WMT) ticker into a search query. I mean, there aren’t a lot of sickos out there deliberately combing over $4 billion market cap, thinly traded insurance companies with no Wall Street analysts covering them.

Fortunately (unfortunately?), you found one of those sicko’s newsletters.

There is a lot under the hood at this relatively small company, but a big reason I want to discuss this company relates to a larger question.

How much leash should you give one of your investments? If it has been a long-term winner and the business has not changed much, how long are you willing to tolerate underperformance?

Since going public in 1985 as the Fireman’s Fund (then the largest IPO in American history), White Mountain Insurance has been a spectacular investment that has generated a total return of 9,200% to date.

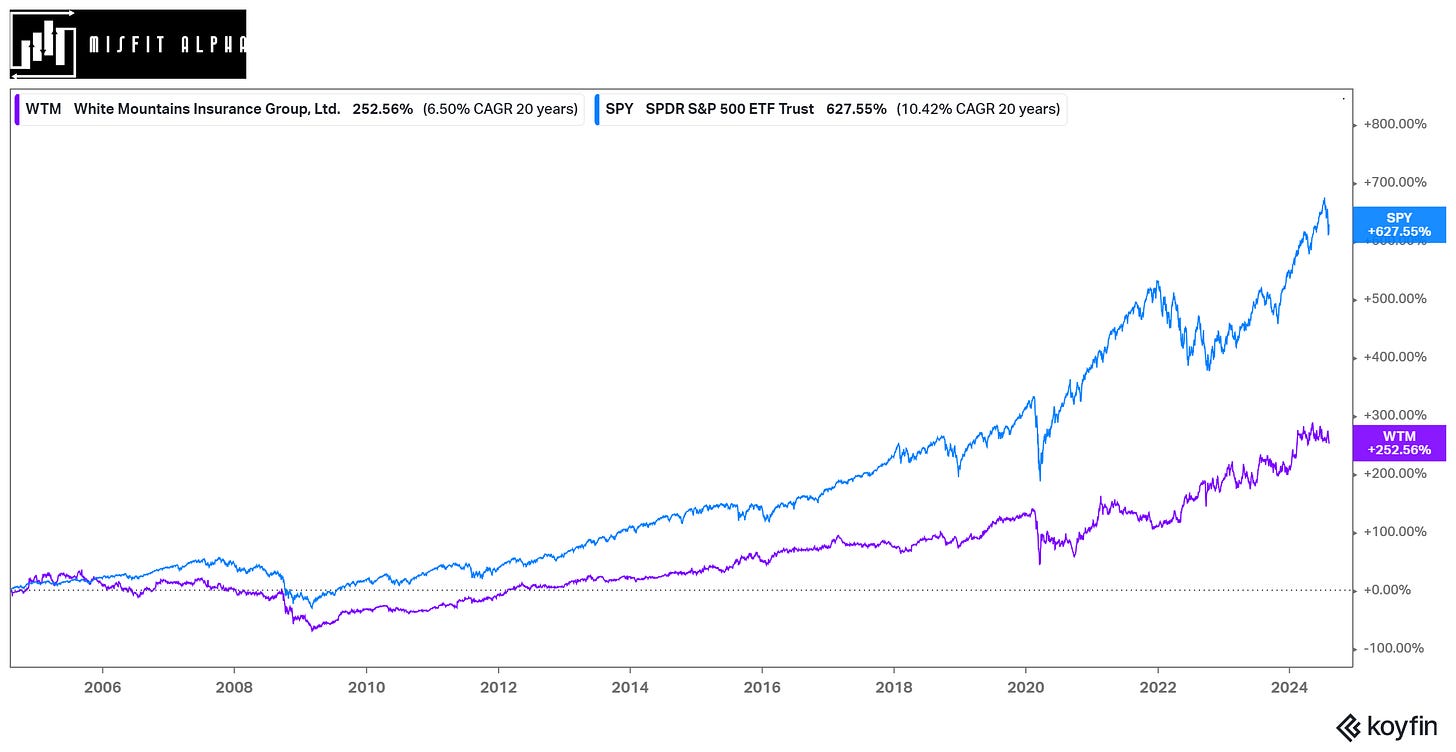

Despite that fantastic performance, White Mountains has been a laggard over the past 3, 5, 10, and 20 years.

White Mountains’s core strategy hasn’t changed, nor has it become any more or less conservative of a business. So what makes a company perform so well and suddenly become a laggard, and more specifically, what is an investor to do with investments that fit this profile?

Let’s dig in

Shoutout to Koyfin for their data and charts. Koyfin has become an integral part of how I screen for, track, and analyze companies. It has made the analysis process much faster thanks to having a decade of data at my fingertips instead of manually going through stacks of quarterly and annual filings.

Where else are you going to find pricing data back to 1968?

Up your analysis process by Signing up for Koyfin. Click on the link below and receive 10% off your annual subscription.