The Misfits: SPX Technology (SPXC)

Even when times seem stressful or uncertain, we shouldn't abandon our investing frameworks.

Writing this newsletter as if this week’s tariff announcement didn’t happen would be nonsensical. As with many recent executive decisions, I (nor anyone else, for that matter) don’t know whether the Trump Administration’s recent tariff regimen is just a week-long news headline or the new normal of global trade. Either way, the announcement alone will make many investors and corporate executives think profoundly about deploying future capital.

I could write a long explainer piece on the impact of tariffs on companies and global trade. I could also engage in a long diatribe that would either confirm or defy your already established view of what this move will mean for your investments.

But times like this, I’m reminded of this short story about my grandmother.

Context: My grandmother called to tell my mom and the rest of the family that their car caught fire while they were driving to pick my brother and me up (this is the unsurprising part of the story; my grandfather wasn’t great about vehicle maintenance).

She delivered the news as if the event were as benign as discussing the weather while we were panicked. My mom asked her how she seemed so calm about having the car go up in flames. I’ll remember her response's exact phrasing and tone for the rest of my life.

”Well, I survived the Blitz of London and went about my life; this isn’t worse than that.”

Comparing hiding out in the London underground in fear of the Luftwaffe to a 10% drop in the NASDAQ sounds silly, but there is a lesson in fear and how one can cope with it.

We can completely alter our daily lives or go about living while taking the necessary precautions.

Translated to investing: We can throw our entire investing framework out the window, or we can incorporate these new dynamics to our existing frameworks and research process.

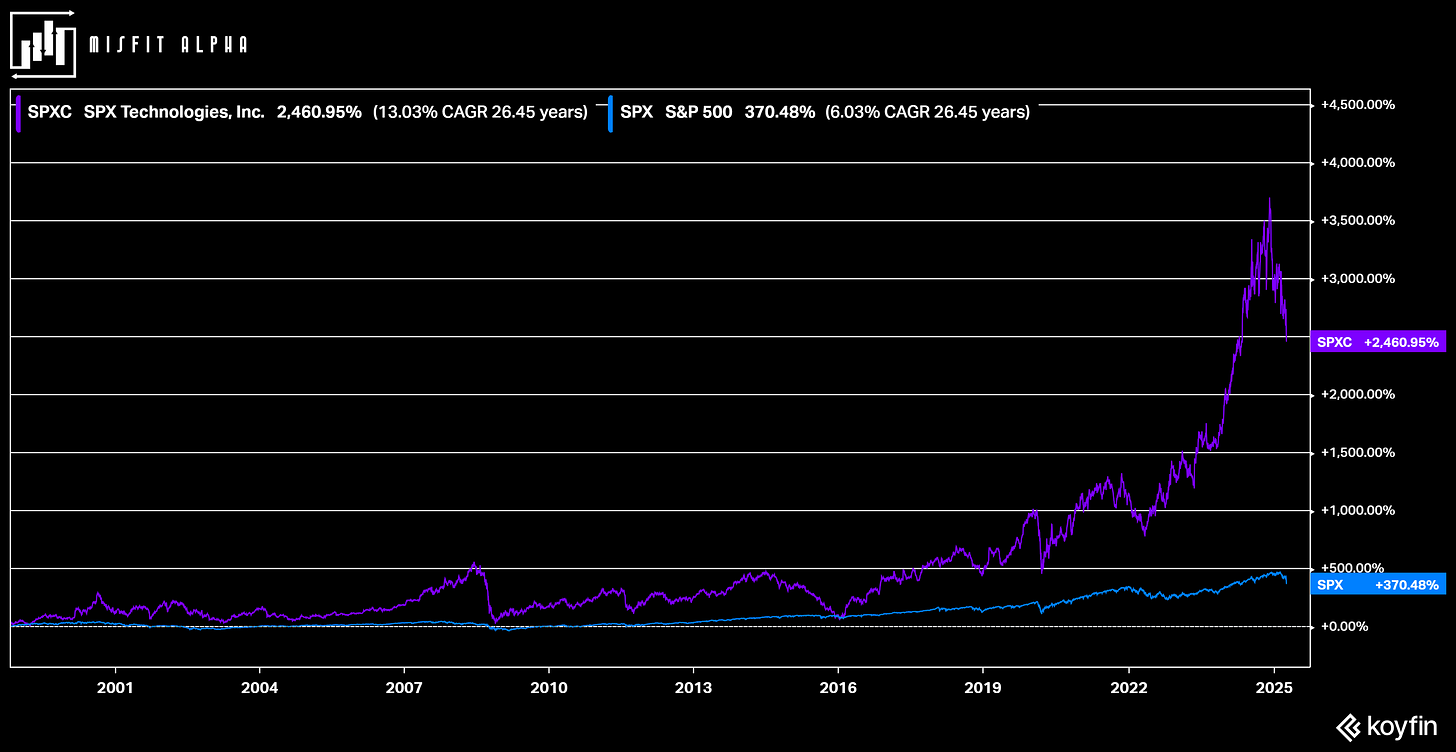

So, in the spirit of maintaining an investing framework and research process. I’m going to continue my regular company profiles with SPX Technologies (NASDAQ: SPXC). The century-old diversified manufacturer is in no way the same company it started out as, but its transformations over the years have translated into strong returns for its investors since it went public.

SPX is an interesting case in chameleon companies and is a business story that can make investors wonder when a company goes from diversified to diworsified.

Let’s get on with our lives and dig in.

Shoutout to Koyfin for their data and charts. Koyfin has become an integral part of how I screen for, track, and analyze companies. Thanks to having a decade of data at my fingertips instead of manually going through stacks of quarterly and annual filings, the analysis process has become more thorough and much faster.

Up your analysis process by Signing up for Koyfin. Click on the link below and receive 10% off your annual subscription.