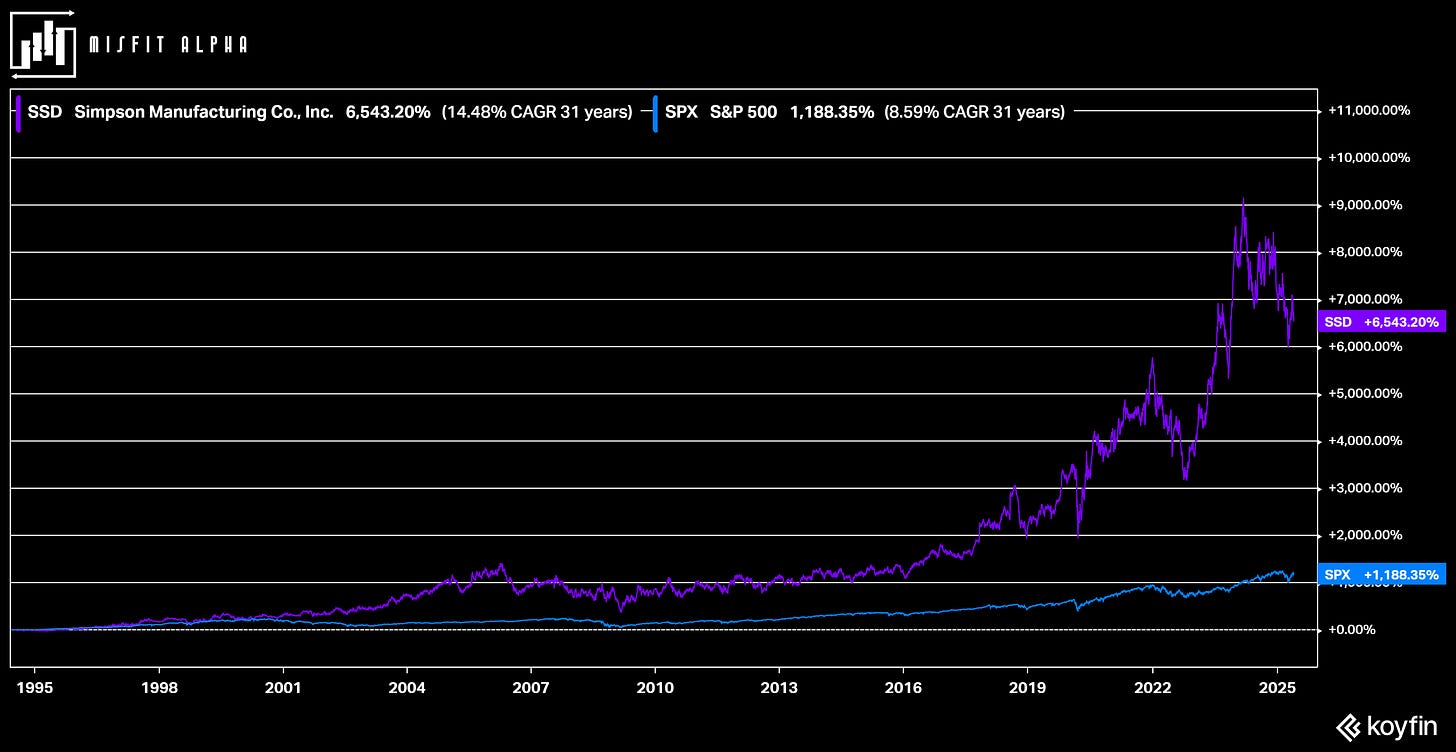

The Misfits: Simpson Manufacturing Company (SSD)

Despite wall-to-wall coverage of the stock market, companies like Simpson Manufacturing still fall through the cracks.

Here’s a real oddity of the investing world. With all of the stock screening tools, the numerous institutional investors, and an endless supply of analysts, it’s surprising to see how many companies produce exceptional returns and still get little to no market attention. With dozens of companies profiled here, we've only scratched the surface.

Of all the industries out there, building products has to have the highest rate of return to Wall Street coverage ratio. Most of the building product companies profiled here are lucky to have one or two analysts covering the stock.

Simpson Manufacturing Company (NYSE: SSD) may have more coverage than others. Still, three analysts isn’t exactly what you would call wall-to-wall coverage for a company that has produced a 14.5% annualized return since going public a little over 30 years ago.

Let’s dig in.

Shoutout to Koyfin for their data and charts. Koyfin has become an integral part of how I screen for, track, and analyze companies. Thanks to having a decade of data at my fingertips instead of manually going through stacks of quarterly and annual filings, the analysis process has become more thorough and much faster.

Up your analysis process by signing up for Koyfin. Click on the link below and receive 10% off your annual subscription.