The Misfits: Old Republic International Corporation (ORI)

Does a company ever make you wonder if you are investing the right way? Old Republic International made me question mine.

I’m bewildered by the insurance industry.

Not because its a bad investment (most insurers are good) or because its a sleepy business (lots of good businesses are).

What bewilders me about this business is how those of us in financial media cover it.

There are two ways the industry is covered.

Berkshire voyeurism: Insurance is just a float for Buffett’s endeavors in publicly traded companies. The Berkshire 13F is treated as if it came down from Mt. Sinai. Even Markel (NYSE: MKL), the closest asimile to Berkshire in terms of structure and with a significant equity & private company portfolio, barely raises the market’s eyebrows with its 13F.

An emerging industry darling: There is always someone looking to “disrupt” the insurance market. Whether it be industry execs tackling an underserved (and highly profitable) segment of the market a la Kinsale Capital (NYSE: KNSL), or some technology-focused startup a la Lemonade (NASDAQ: LMND) that is “fixing” insurance.

There is some value in these discussions (although the Berkshire 13F thing is getting a little long in the tooth). What vexes me is that these are seemingly the only narratives worth discussing in insurance.

That’s where so many of us in the investment writing community fail. So many companies in this industry have stellar track records of value creation over time. And yet so few of them can get the time of day from retail investors and the mediasphere catering to them. I’ve covered a few of the oddball investments in insurance that have produced outstanding results. Still, just as many bread-and-butter insurance companies have run laps around the broader market without Wall Street fanfare or media attention.

Case in point: Old Republic International (NYSE: ORI)

Old Republic isn’t a glamorous business. The $9 billion makret cap insurer is nowhere near the largest in the markets it competes. It isn’t some plucky startup, either (it’s over 100 years old).

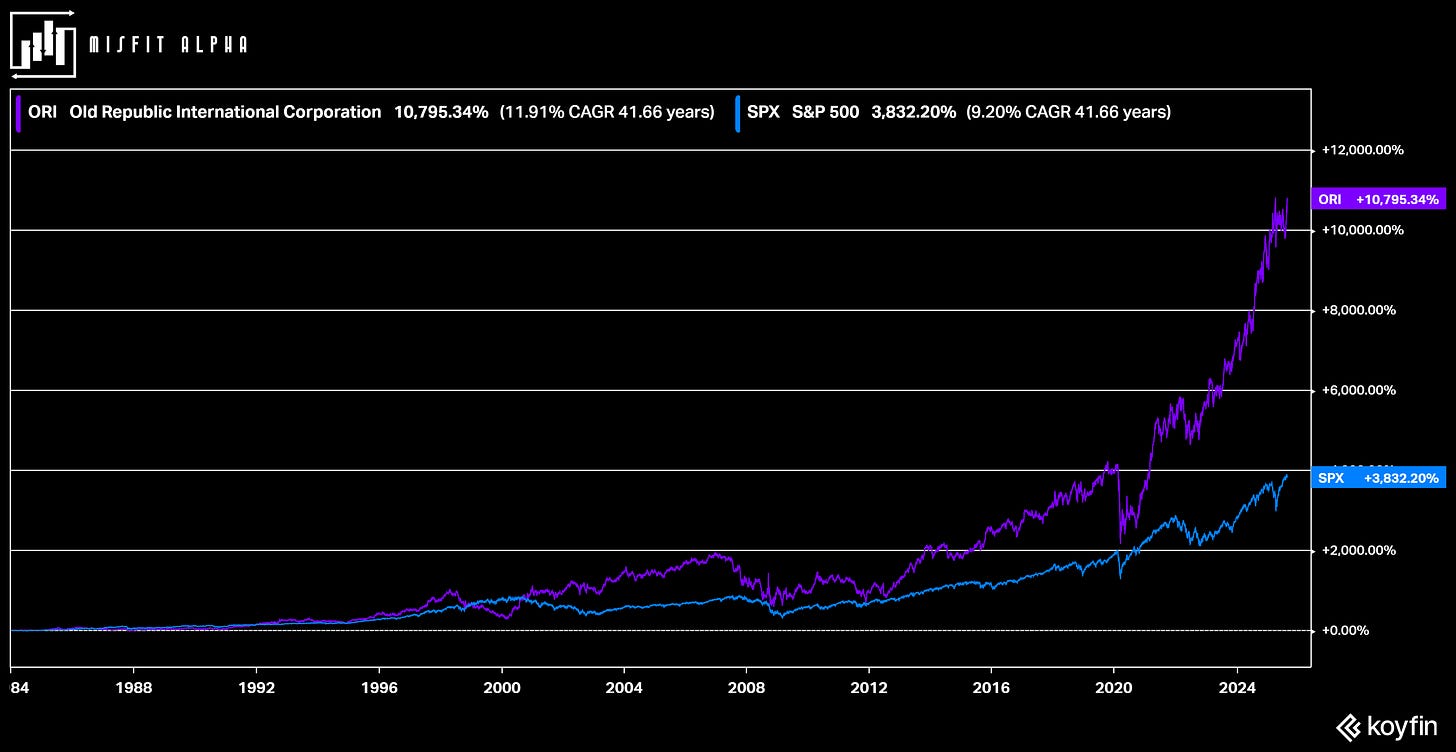

And yet, the company continues to deliver the kind of performance investors wish they could achieve.

We’ve dug into lots of companies with similar underappreciated businesses like Old Republic. But if you stare at that chart and Old Republic’s deliberately bland business, you might start asking the same question I did.

Are we doing this investing thing right?