The Misfits: Enpro Inc. (NPO)

The long-tenured manufacturer can be hard to follow because of how often it changes.

It can sometimes be hard to follow manufacturing companies because they often change their stripes. The industry is peppered with companies that have formed, merged, spun off, entered new markets, and exited others. It can be challenging to be well-versed in a company and its end markets when their end markets change so frequently.

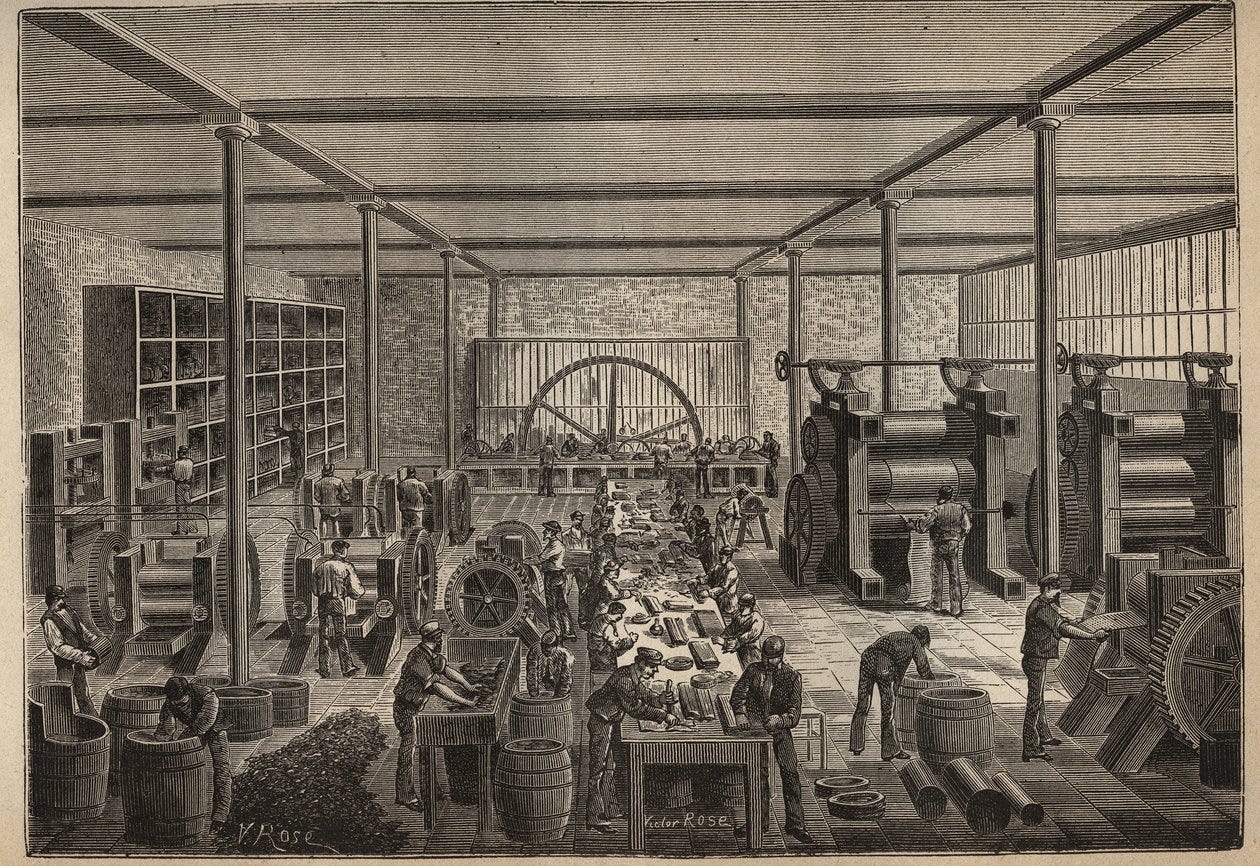

One such example of this is Enpro Inc. (NYSE: NPO). Technically, the company has been around for more than 150 years in some form or another and has made a wide variety of products.

The most recent iteration of Enpro has become a little more focused over time, and this has worked out rather well for the company since it was spun out of an industrial conglomerate 20 years ago.

As has been the case for much of Enpro’s history, the company is in the midst of another corporate transformation. While many investors will probably like the direction management is taking, the greatest risks for the company probably lie in its past.

Shoutout to Koyfin for their data and charts. Koyfin has become an integral part of how I screen for, track, and analyze companies. It has made the analysis process much faster thanks to having a decade of data at my fingertips instead of manually going through stacks of quarterly and annual filings.

Up your analysis process by Signing up for Koyfin. Click on the link below and receive 10% off your annual subscription.