The Misfits: Cummins (CMI)

The long-time manufacturer of engines is both unloved and at a crossroads.

The original idea of a Misfit stock was those underappreciated stocks. Underappreciated doesn’t mean obscure, though. Sometimes, it can mean more well-known businesses that are seemingly left for dead.

Cummins (NYSE: CMI) fits into that latter category. By no means is a company with 22 Wall Street analysts an obscure or undercovered company.

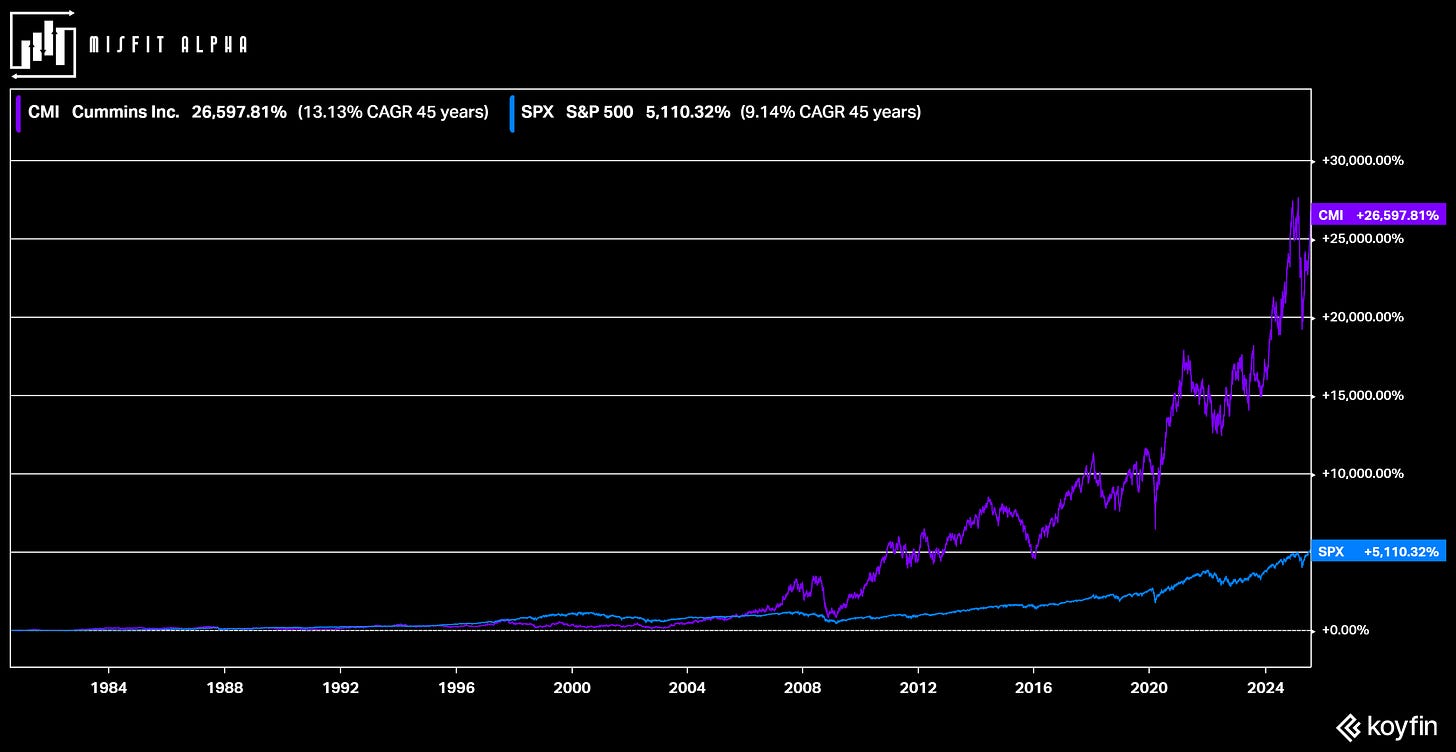

It’s also not hard to see why investors have thrown a company as quality as Cummins into the “no, thanks” pile. I don’t agree with why I think Cummins gets overlooked these days, though, and I think by the end of this, you’ll agree. Even though its business is “dying,” it has posted market-beating results over the past 1, 3, 5, 10, 20-year investment period.

Cummins also poses a challenging question for its management and investors in industries under long-term threat of obsolescence, and how to appropriately compensate a team to facilitate change.

Let’s dig in.