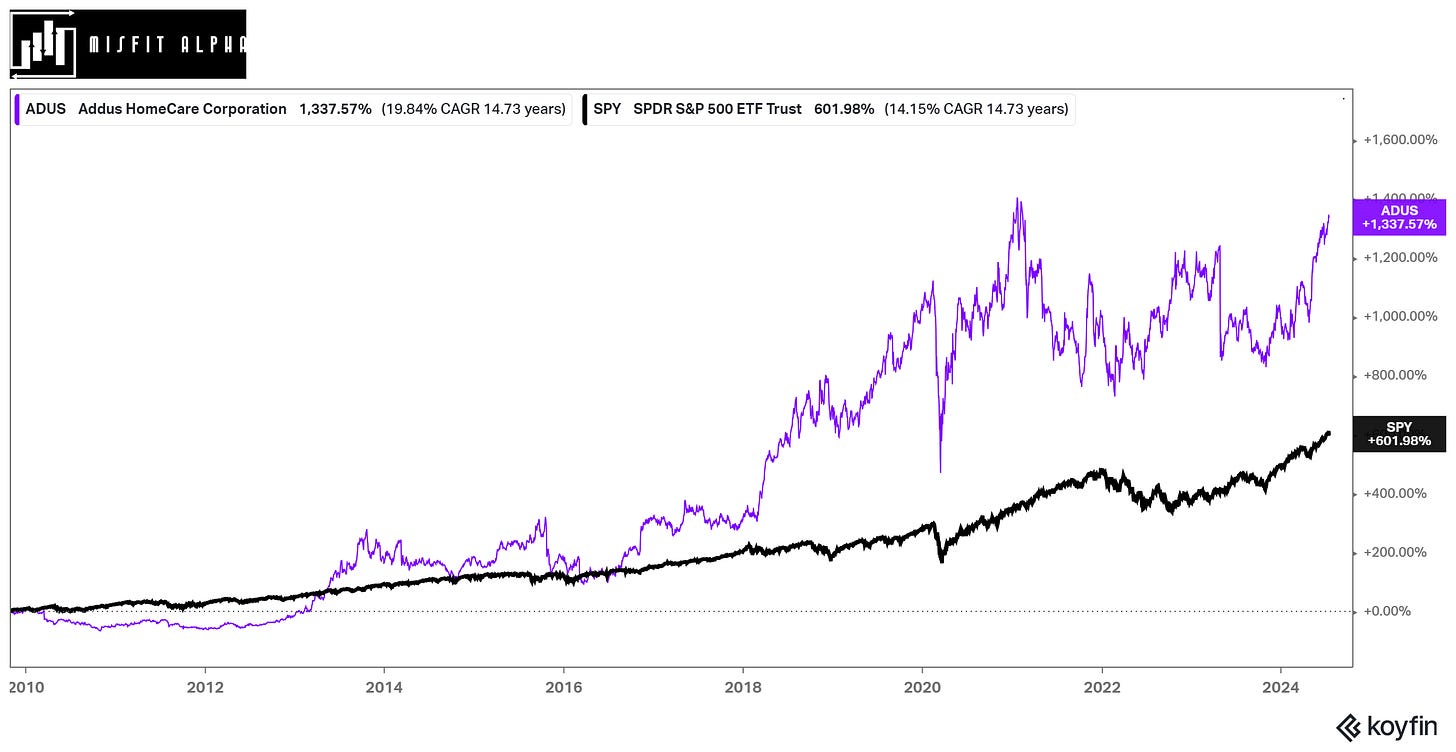

The Misfits: Addus HomeCare Corporation (ADUS)

The in-home caregiver has walked a narrow path to success.

Is a company a good investment simply because its stock has gone up for a long time? I struggle with this question quite a bit. There are great companies in mediocre industries and decent businesses in great industries that generate spectacular wealth for their investors. There is also this unique group of companies that continue to generate good results for their investors, but you wonder how they have been able to do it.

Addus HomeCare Corporation (NASDAQ: ADUS) falls into that last bucket. It has generated spectacular long-term results for its investors, but the industry in which it operates, its financials, and the way management is compensated make you wonder how it managed to pull it off.

Companies aren’t successful for a decade and a half without having one good quality or two. So, let’s look at what has made Addus HomeCare a market-beating investment, why its path to success is a little harder to explain, and what it will take for this company to continue its success.

Shoutout to Koyfin for their data and charts. Koyfin has become an integral part of how I screen for, track, and analyze companies. It has made the analysis process much faster thanks to having a decade of data at my fingertips instead of manually going through stacks of quarterly and annual filings.

Up your analysis process by Signing up for Koyfin. Click on the link below and receive 10% off your annual subscription.