Take Your Historical Trends and Throw Them in the Rubbish

Comparing today's market to what we have seen over the past 10 years isn't as impactful as many people think.

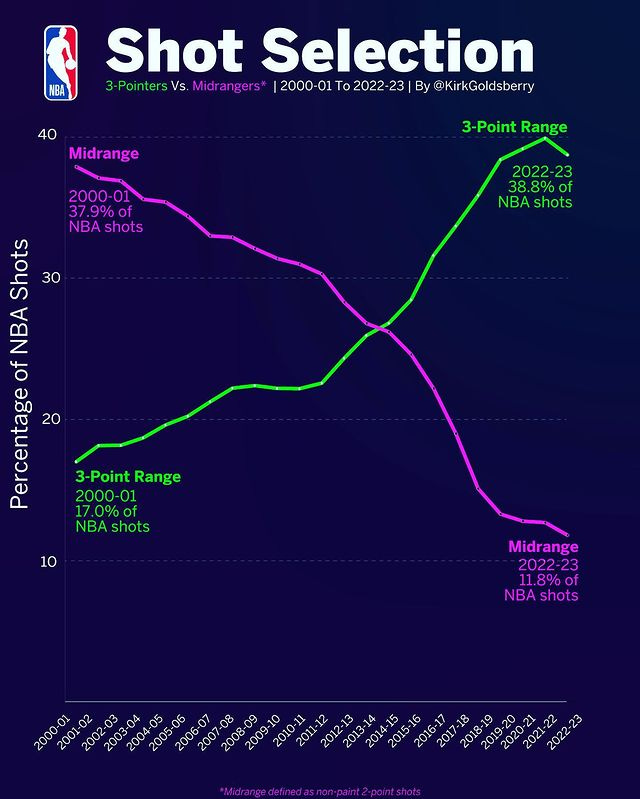

If you watch NBA games from more than 10 years ago, you would think you were watching an entirely different game than the one played today. The analytical revolution has changed the way we think about scoring, shot selection, skill sets, player positions, and outcome variability.

The way the game is played has changed so much that the idea of comparing results to historical averages seems pointless. Of the top 50 three-point scorers in NBA history, only four had careers that started before 1990. Not necessarily because players are that much better shooters today (perhaps a topic for debate), but because analysts and coaches have determined that it is far more optimal for teams to take many more threes per game than in prior decades.

A similar effect has occurred recently in financial markets. Financial writers, journalists, and social media posts have recently highlighted recent highs for interest rates, treasury yields, dividend yields, and other market metrics hitting highs we haven’t seen in 10 years or more.

Unfortunately, too many investing writers and analysts are framing these historical highs as “once-in-a-decade opportunities” or some other emphatic declaration of buying opportunities. Like the NBA from a decade ago, trying to use the past 10-15 years of data to make declarations about how to invest is playing a game that may no longer exist.

But first…

Shoutout to Koyfin, one of the best financial data platforms out there today. Koyfin has become an integral part of how I screen for, track, and analyze companies. It has made the analysis process much faster thanks to having a decade's worth of data at my fingertips instead of manually going through stacks of quarterly and annual filings.

Up your analysis process by Signing up for Koyfin. Click on the link below and receive 10% off your annual subscription.