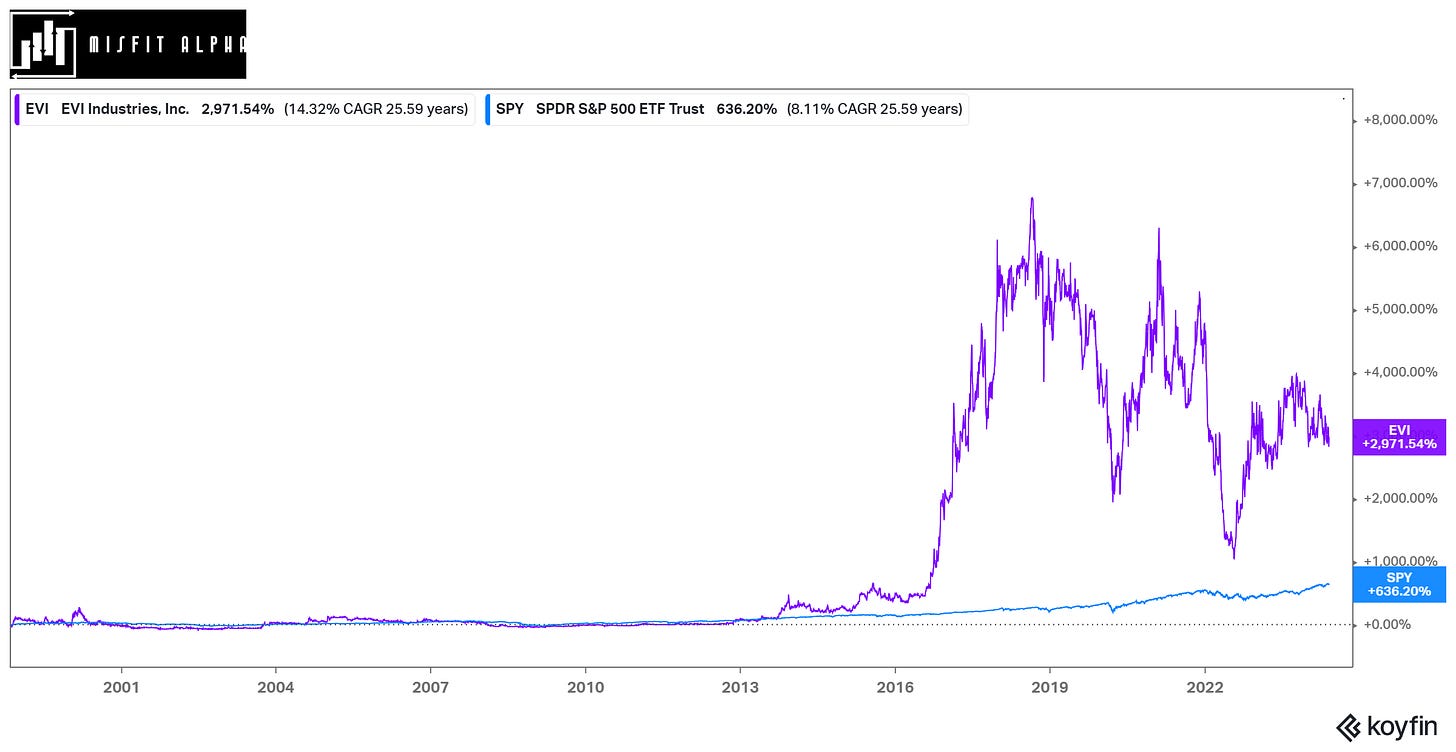

Maybe a Misfit? EVI Industries (EVI)

It's hard to call a $250 million company a wealth compounder, but it draws parallels to many long-term winners

I think I may be getting a little ahead of myself….

Typically, I reserve these company profiles for companies that have generated spectacular returns over long periods. EVI Industries (NYSEAMERICAN: EVI) doesn’t necessarily fit that description.

A microcap company that saw substantial gains relatively quickly should be a red flag that this was some flash in the pan.

Heck, anything that’s a $265 million company should be held to a higher degree of skepticism because it hasn’t proven itself.

And yet, I can’t stop thinking about it.

Several investing themes have emerged over the past year while writing Misdit Alpha. Some of the best investments share a few characteristics. Even though EVI Industries has yet to prove it should be considered among these great investments, it shares many of these characteristics.

Let’s dig into what EVI Industries appears to be doing right.

Shoutout to Koyfin for their data and charts. Koyfin has become an integral part of how I screen for, track, and analyze companies. It has made the analysis process much faster thanks to having a decade of data at my fingertips instead of manually going through stacks of quarterly and annual filings.

Up your analysis process by Signing up for Koyfin. Click on the link below and receive 10% off your annual subscription.