Is This a Misfit?: Arrow Electronics (ARW)

Investments can challenge our investing frameworks and theories. This electronic component distributors challenges some of mine.

I conceived the idea for this newsletter with two objectives in mind:

Identify and highlight some of the best-performing stocks that most investors ignore.

Look for common traits among these disparate companies to help identify future outperformance.

We’re close to two years and 100 companies profiled here. People following this work have likely noticed two common traits that make for a Misfit stock.

Rates of return in the teens over decades. Rates of return in this range comfortably outpace their cost of capital but don’t attract too much competition or investor attention.

Management teams with incentives well aligned with investor outcomes.

What has surprised me about investment criteria is the types of businesses that often meet these two criteria: industrial manufacturers, chemical companies, automotive dealerships, distributors, the “behind-the-scenes” companies in healthcare, insurance brokers, etc.

The thing about rules and criteria is that there will be exceptions and head-scratchers. These are the companies that meet our rules and criteria, but hasn’t delivered outperformance relative to the market.

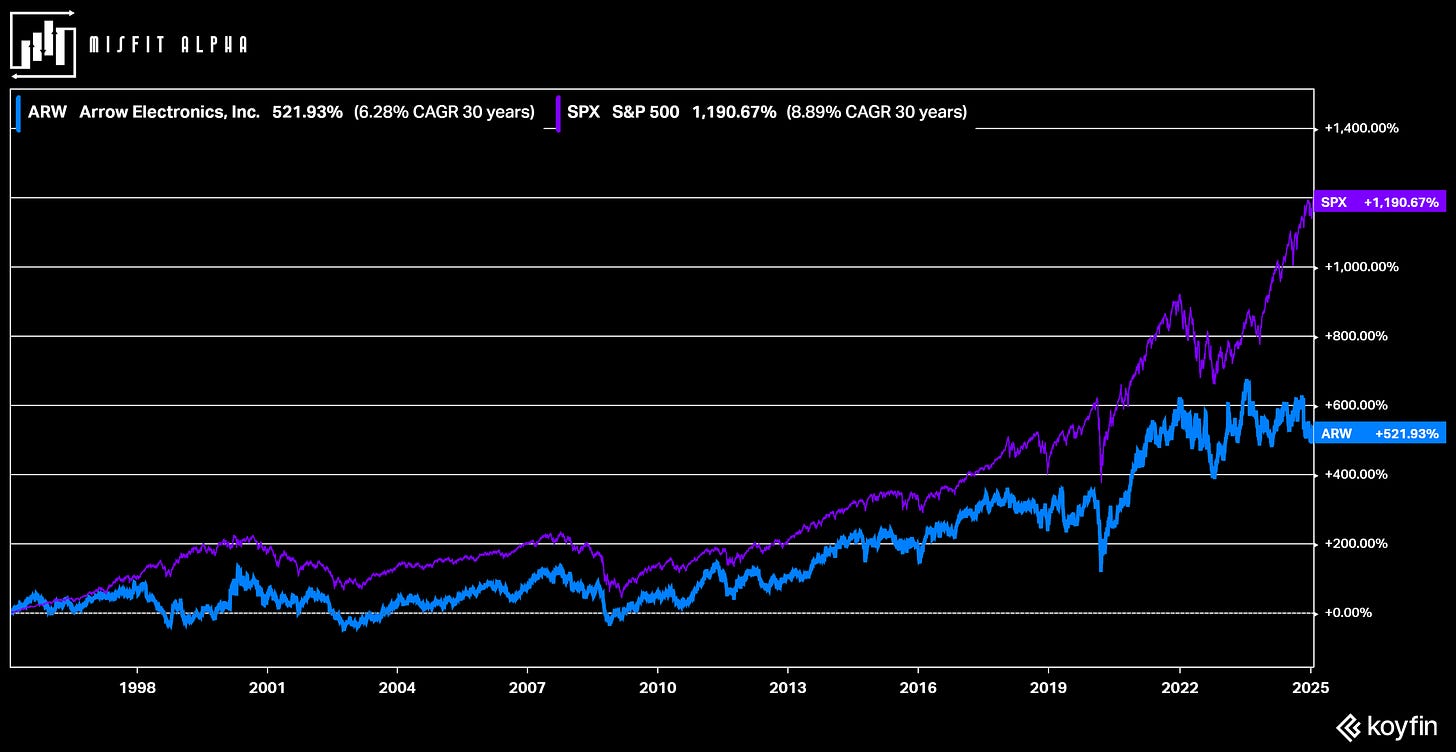

One such company is Arrow Electronics (NYSE: ARW). If you were to tell me the company’s business and management’s compensation package and then ask how it performed over the past 30 years, I would almost certainly have guessed it smashed the market.

That hasn’t been the case…

Dissecting why an investment didn’t work is a valuable exercise because it can help us fine-tune our research process and investment philosophy. So, let’s look at why Arrow seems to fit this investing criteria but hasn’t been able to deliver returns similar to other companies with its profile.

Shoutout to Koyfin for their data and charts. Koyfin has become an integral part of how I screen for, track, and analyze companies. It has made the analysis process much faster thanks to having a decade of data at my fingertips instead of manually going through stacks of quarterly and annual filings.

Up your analysis process by Signing up for Koyfin. Click on the link below and receive 10% off your annual subscription.